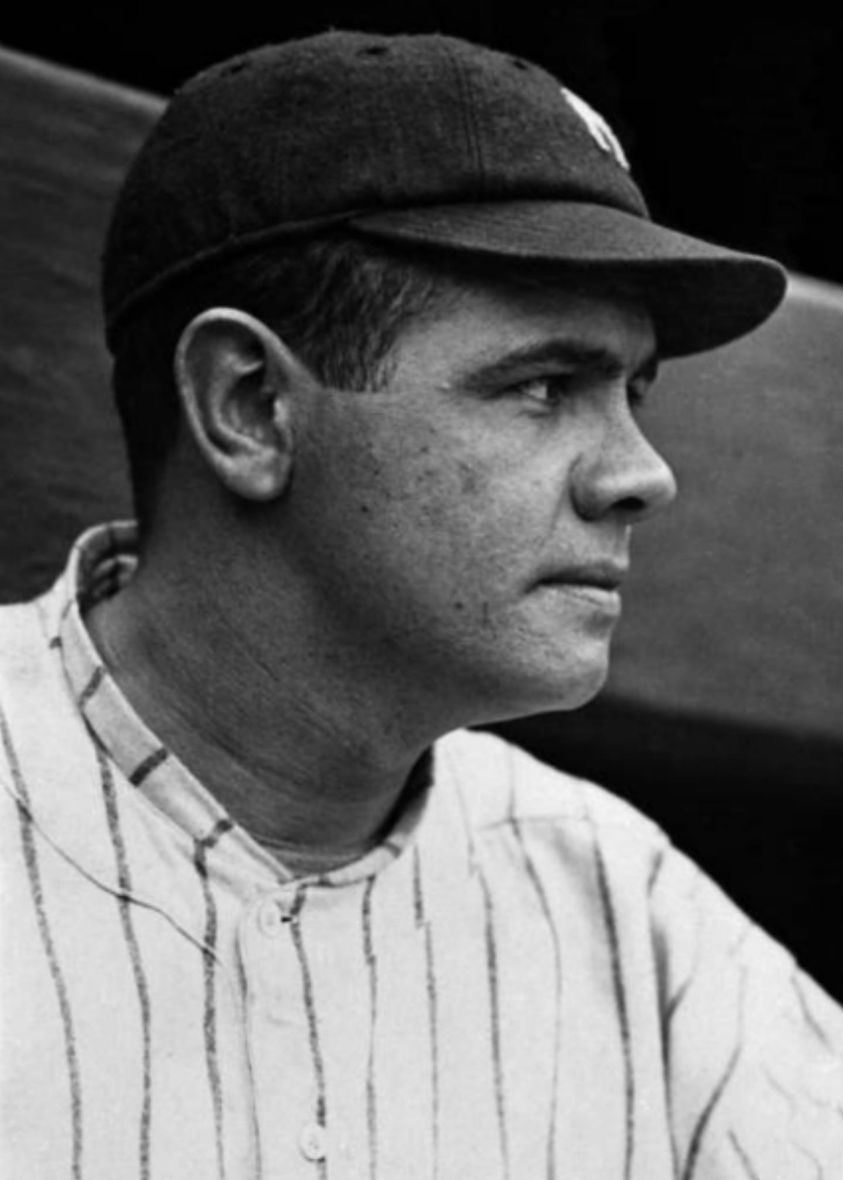

Discover Your Favorite Baseball Memories

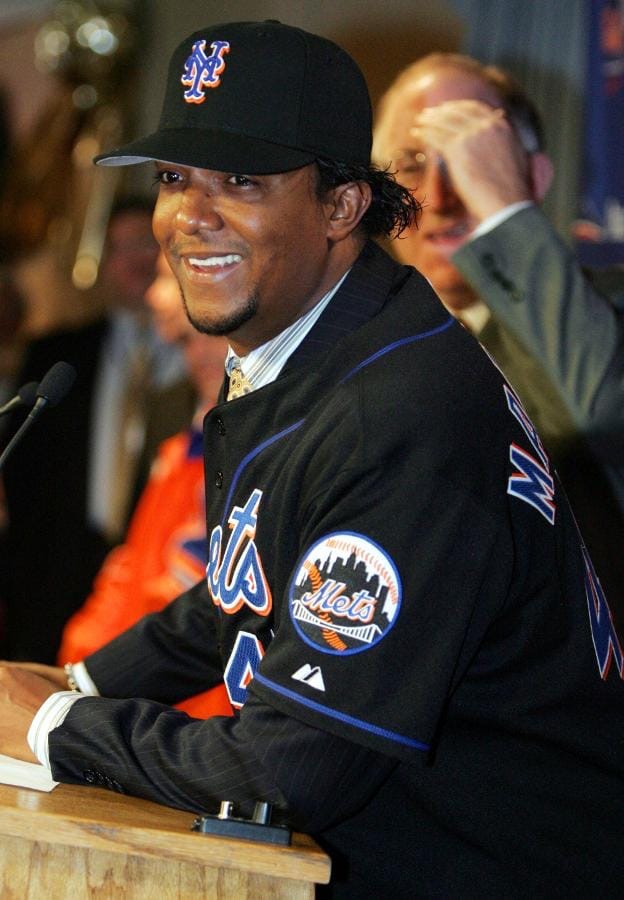

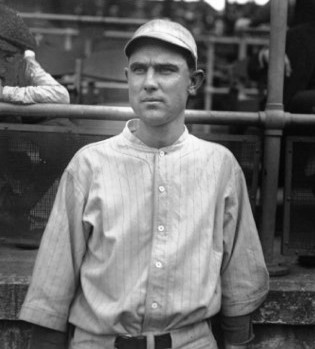

Pedro Martinez becomes the 15th major league pitcher to record 3,000 career strikeouts

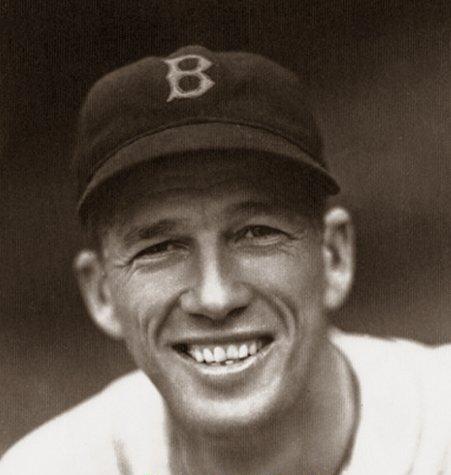

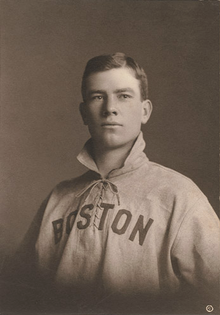

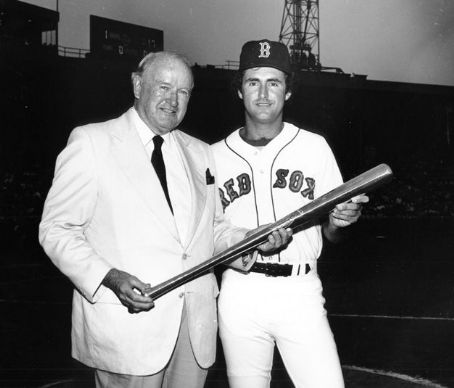

Lefty Grove of the Boston Red Sox wins his 300th game

Recommended

Trending News

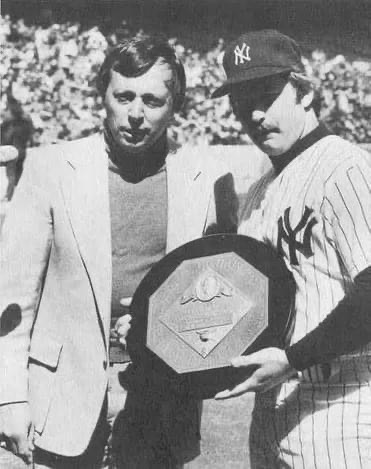

Thurman Munson wins the 1976 AL MVP

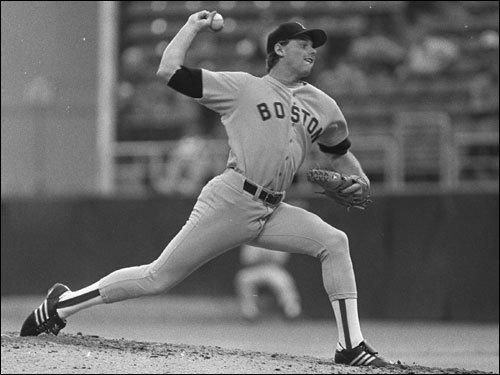

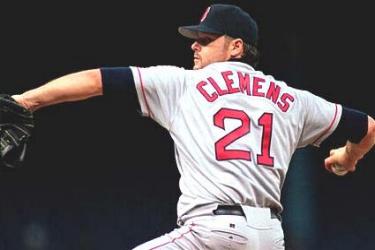

The Tigers’ Justin Verlander wins the American League Most Valuable Player Award the first starter since Roger Clemens in 1986

Boston Red Sox center fielder Fred Lynn becomes the first rookie ever to be named American League Most Valuable Player

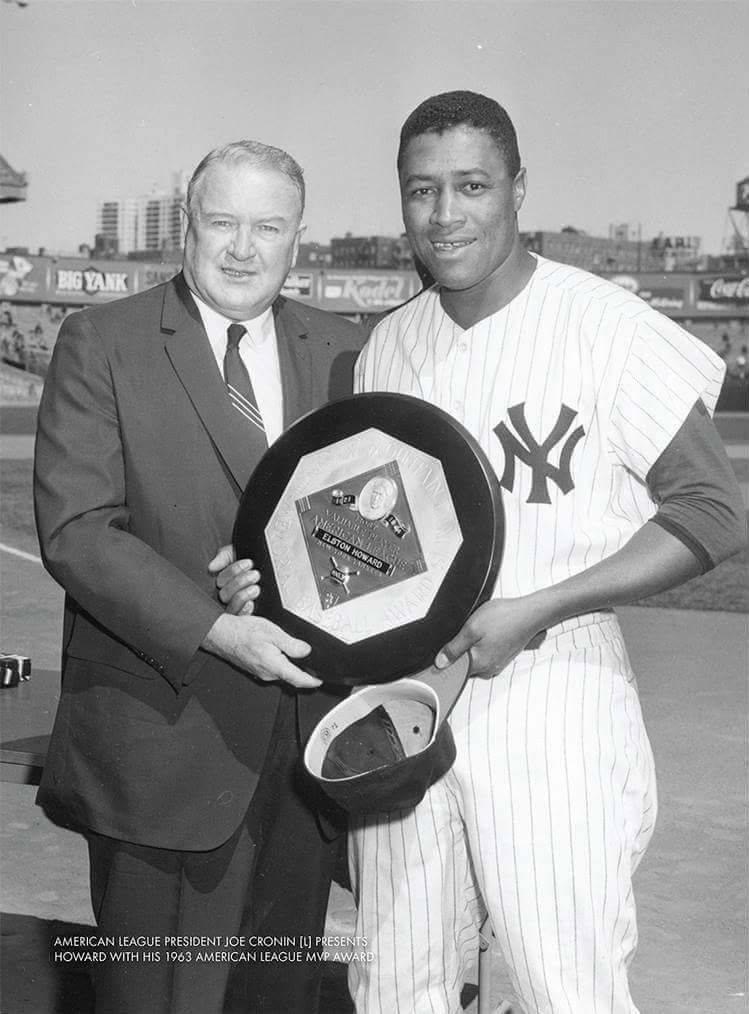

New York Yankees catcher Elston Howard becomes the first black player to win the American League MVP Award

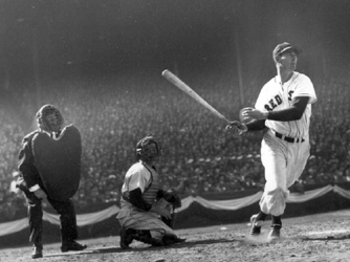

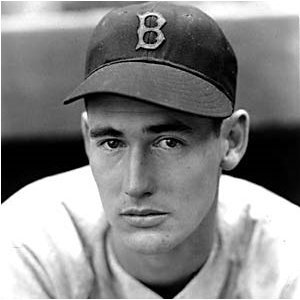

Ted Williams of the Boston Red Sox wins his first Most Valuable Player Award

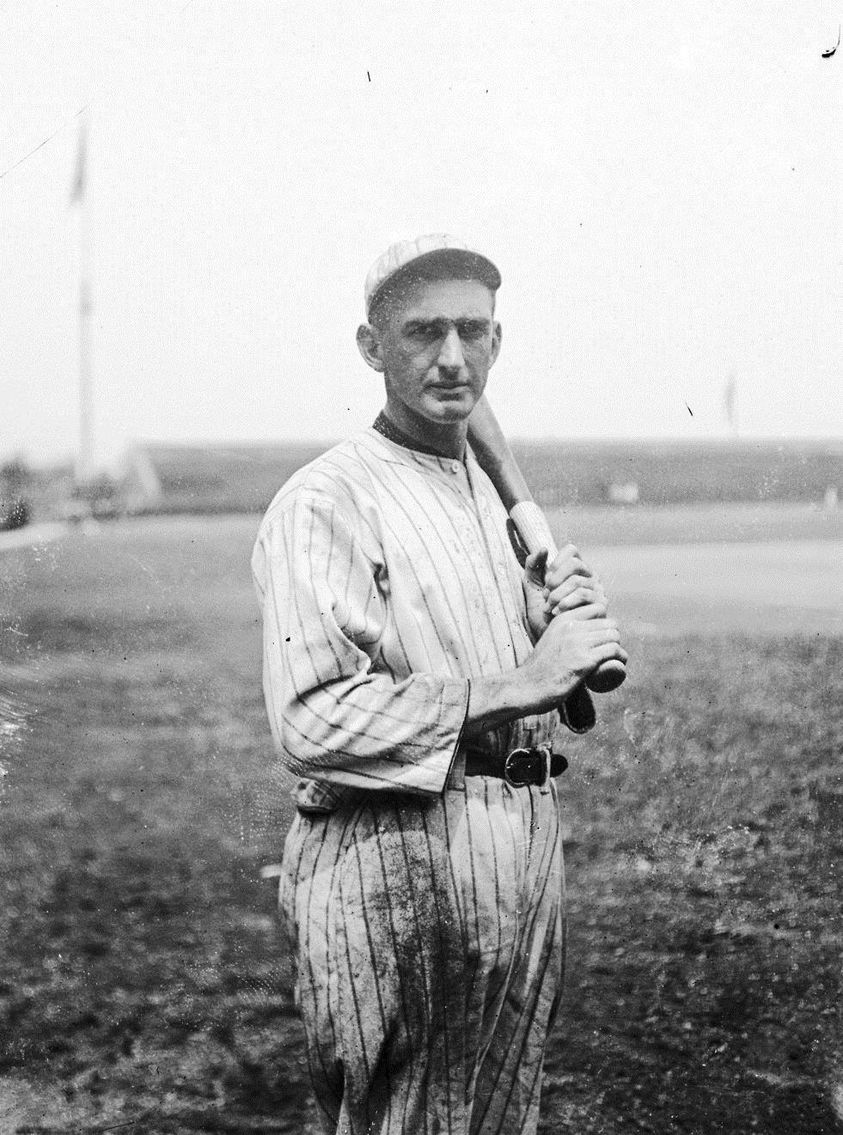

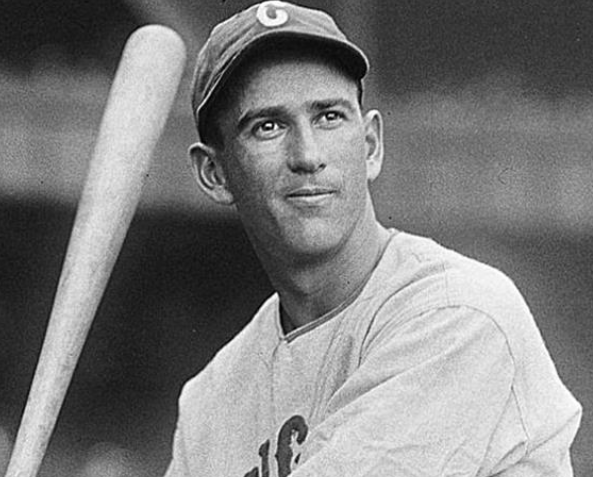

Jimmie Foxx wins American League MVP

-

College Baseball Teams: A Complete List of Schools for Future Students

Navigating the vast landscape of college baseball can be as challenging as hitting a curveball. With hundreds of institutions offering baseball programs across various divisions, future students with dreams of diamond glory need a comprehensive guide to make their college selection process as smooth as a well-oiled glove. This article outlines the tiers of college…

-

6 Budgeting Strategies You Should Master Before Wagering On The MLB

Betting on Major League Baseball (MLB) can be an exhilarating way to enhance your viewing experience, deepen your connection with the sport, and potentially earn some extra cash. However, without a solid financial strategy, the thrill of the game can quickly turn into a source of stress. Mastering a set of budgeting strategies is crucial…

-

Unique Career Opportunities in Baseball

Unique Career Opportunities in Baseball Your passion for sports needs a direction that can lead to a secure professional career. Playing baseball for fun is fine, but when you need to make it a source of income for a stable future, you have to be extra careful about your selections. Careful consideration of top careers…

-

How to Capitalize on NBA Betting Upsets

How to Capitalize on NBA Betting Upsets Imagine sitting in front of your screen, analyzing the odds for the upcoming NBA games. Among the predictions, your eyes catch a glimpse of this weeks NBA predictions and something clicks. There’s an underdog there that might just have a chance. This scenario isn’t rare in the world of sports…

-

March 14 – Spring Training Game Live Stream Pittsburgh Pirates at Baltimore Orioles

March 14 – Spring Training Game Live Stream Pittsburgh Pirates at Baltimore Orioles – 7:05pm ET

-

4 Up-and-Coming Athletes Set to Dominate This Season

As the anticipation for the upcoming season builds, the spotlight shines on a select group of athletes poised for breakthrough performances. These players, previously celebrated as top prospects, have tasted success at the Major League level through brief flashes of brilliance or sustained periods of promise. Now, standing on the precipice of greatness, they…